Page 314 - Emerging Trends and Innovations in Web-Based Applications and Technologies

P. 314

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

4.3. Post-Pandemic Trends

Rental tastes have changed as a result of the COVID-19 epidemic, with a greater desire for larger areas, suburban settings, and

homes with amenities that allow for remote work. Furthermore, short-term rentals and variable lease durations have grown in

popularity, which has changed the dynamics of the market.

5. Rental Market:- Growing Urbanization Fuels Rental Demand and Prices

India's rental housing market continues to gain momentum, driven by strong economic fundamentals and enhanced

government initiatives aimed at improving transparency and accessibility. Key measures introduced in the Union Budget 2024-

2025, such as public-private partnerships to develop dormitory-style housing for industrial workers and the PM Awas Yojana

Urban 2.0, are expected to bolster workforce migration and increase demand for rental properties.

According to the latest Rental Index report by Magicbricks, rental property demand experienced a marginal year-on-year

decline of 0.5% in Q2 2024. However, regional patterns showed considerable variation. Thane (18.80%), Delhi (18.00%), and

Ahmedabad (15.20%) saw the highest year-on-year growth, while Bengaluru (-11.00%), Hyderabad (-8.50%), and Gurugram (-

7.60%) reported declines. Despite these regional disparities, overall demand for rental housing in India remains robust,

supported by rising employment, rapid urbanization, and improved connectivity.

On the supply side, the availability of rental housing struggled to keep pace with demand, showing a 3.10% year-on-year

decline in Q2 2024. Chennai (-37.30%), Bengaluru (-11.50%), and Kolkata (-9.60%) experienced the steepest reductions in

rental housing stock. Conversely, Noida (32.40%), Greater Noida (29.00%), and Gurugram (25.90%) saw the most substantial

increases in rental supply over the same period.

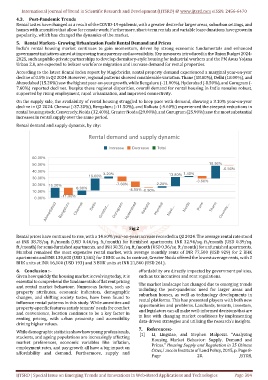

Rental demand and supply dynamic, by city:

Rental demand and supply dynamic

Increase Decrease Total

60.00%

50.00% 18.80%

-0.50%

40.00% 1.40%

18.00% 3.20% 13.80%

30.00% -3.60%

20.00% 15.20% 6.90% -7.60% 2.20%

10.00% -8.50% -0.90%

0.00% -11.00%

Ahmedabad Bengaluru Chennai Delhi Greater … Gurugram Hyderabad Kolkata Mumbai Navi … Noida Pune Thane Country …

Fig.2

Rental prices have continued to rise, with a 14.60% year-on-year increase recorded in Q2 2024. The average rental rate stood

at INR 38.78/sq. ft./month (USD 0.46/sq. ft./month) for furnished apartments, INR 32.94/sq. ft./month (USD 0.39/sq.

ft./month) for semi-furnished apartments, and INR 30.35/sq. ft./month (USD 0.36/sq. ft./month) for unfurnished apartments.

Mumbai remained the most expensive rental market, with average monthly rents of INR 77,500 (USD 929) for 2 BHK

apartments and INR 130,600 (USD 1,565) for 3 BHK units. In contrast, Greater Noida offered the lowest average rents, with 2

BHK units at INR 16,100 (USD 193) and 3 BHK units at INR 21,800 (USD 261).

6. Conclusion :– affordability are directly impacted by government policies,

Given how quickly the housing market is evolving today, it is such as tax incentives and rent regulations.

essential to comprehend the fundamentals of flat rent pricing

and rental market behaviour. Numerous factors, such as The market landscape has changed due to emerging trends

including the post-pandemic need for larger areas and

property attributes, economic indicators, demographic suburban houses, as well as technology developments in

changes, and shifting society tastes, have been found to rental platforms. This has presented players with both new

influence rental patterns in this study. While amenities and

property-specific features satisfy tenants' needs for comfort opportunities and problems. Landlords, tenants, investors,

and legislators can all make well-informed decisions that are

and convenience, location continues to be a key factor in in line with changing market conditions by implementing

renting pricing, with urban proximity and accessibility data-driven strategies and utilising the research's insights.

driving higher values.

7. References:-

While demographic statistics show how young professionals, [1] Li, Lingxiao, and Stephen Malpezzi. “Analyzing

students, and ageing populations are increasingly affecting Housing Market Behavior: Supply, Demand and

market preferences, economic variables like inflation, Prices.” Housing Supply and Regulation in 35 Chinese

employment rates, and pay growth all have a big impact on

affordability and demand. Furthermore, supply and Cities, Lincoln Institute of Land Policy, 2015, p. Page 8-

Page 20. JSTOR,

IJTSRD | Special Issue on Emerging Trends and Innovations in Web-Based Applications and Technologies Page 304