Page 107 - Combine

P. 107

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

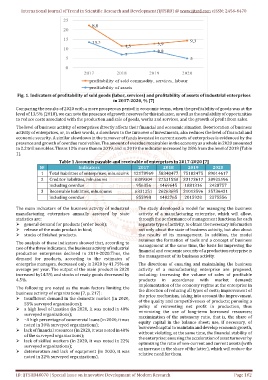

Fig. 1. Indicators of profitability of sold goods (labor, services) and profitability of assets of industrial enterprises

in 2017-2020, % [7]

Comparing the results of 2020 with a more prosperous period in economic terms, when the profitability of goods was at the

level of 13.5% (2018), we can note the presence of growth reserves for this indicator, as well as the availability of opportunities

to reduce costs associated with the production and sale of goods, works and services, and the growth of profit from sales.

The level of business activity of enterprises directly affects their financial and economic situation. Deterioration of business

activity of enterprises, or, in other words, a slowdown in the turnover of investments, also reduces the level of financial and

economic security. A similar slowdown in the turnover of funds invested in current assets of enterprises is evidenced by the

presence and growth of overdue receivables. The amount of overdue receivables in the economy as a whole in 2020 amounted

to 2.2 trillion rubles. This is 12% more than in 2019, and in 2019 the indicator increased by 28% from the level of 2018 (Table

1).

Table 1 Accounts payable and receivable of enterprises in 2017-2020 [7]

№ Indicators 2017 2018 2019 2020

1 Total liabilities of enterprises, mln.soums 12178969 58340477 75182475 89014617

2 Creditor liabilities, mln.soums 6389304 27531558 33173617 38925596

including overdue 956356 1469645 1881316 2428757

3 Receivable liabilities, mln.soums 6331251 26263685 31013596 35736421

including overdue 855998 1482765 2015920 2275556

The main indicators of the business activity of industrial The study developed a model for managing the business

manufacturing enterprises annually assessed by state activity of a manufacturing enterprise, which will allow,

statistics are: through the performance of management functions for each

general demand for products (order book); separate type of activity, to obtain the necessary information

release of the main product in kind; not only about the state of business activity, but also about

stocks of finished products. the results of its management. In addition, the model

assumes the formation of tools and a concept of business

The analysis of these indicators showed that, according to

management at the same time, the basis for improving the

two of the three indicators, the business activity of industrial

financial and economic security of a production enterprise is

production enterprises declined in 2019-2020.Thus, the the management of its business activity.

demand for products, according to the estimates of

enterprise managers, decreased only in 2020 by 41.75% on The directions of ensuring and maintaining the business

average per year. The output of the main product in 2020 activity of a manufacturing enterprise are proposed,

increased by14.5% and stocks of ready goods decreased by including: increasing the volume of sales of profitable

4.5%. products in accordance with market demand;

implementation of the economy regime at the enterprise in

The following are noted as the main factors limiting the

the direction of reducing all types of costs; improvement of

business activity of organizations [7, p. 217]: the price mechanism, taking into account the improvement

insufficient demand in the domestic market (in 2020,

of the quality and competitiveness of products; pursuing a

55% surveyed organizations);

policy of reinvesting net profit in production, thus

a high level of taxation (in 2020, it was noted in 40%

minimizing the use of long-term borrowed resources;

surveyed organizations); maximization of the autonomy ratio, that is, the share of

–A high percentage of commercial loans (in 2020, it was

equity capital in the balance sheet; use, if necessary, of

noted in 30% surveyed organizations);

borrowed capital to maintain and develop economic growth,

lack of financial resources (in 2020, it was noted in 40%

without violating, at the same time, the financial stability of

of the surveyed organizations); the enterprise; ensuring the acceleration of asset turnover by

lack of skilled workers (in 2020, it was noted in 22%

optimizing the ratio of non-current and current assets (with

surveyed organizations);

an increase in the share of the latter), which will reduce the

deterioration and lack of equipment (in 2020, it was relative need for them.

noted in 22% surveyed organizations).

ID: IJTSRD40070 | Special Issue on Innovative Development of Modern Research Page 102