Page 133 - Combine

P. 133

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

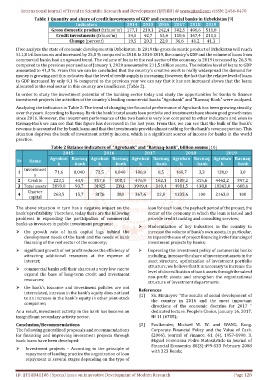

Table 1 Quantity and share of credit investments of GDP and commercial banks in Uzbekistan [9]

Indicators 2014 2015 2016 2017 2018 2019

Gross domestic product (trln.so'm) 177,1 210,1 242,4 302,5 406,6 511,8

Credit investments (trln.so'm) 34,5 42,7 53,4 110,6 167,4 211,5

Change (percent) 19,5 20,3 22,0 36,6 41,2 41,3

If we analyze the state of economic development in Uzbekistan: In 2019 the gross domestic product of Uzbekistan will reach

511,8 trillion soums and increased by 25,8 % compared to 2018. In 2014-2019, the country's GDP and the volume of loans from

commercial banks had an upward trend. The volume of loans to the real sector of the economy in 2019 increased by 26,3 %

compared to the previous year and as of January 1, 2020 amounted to 211,5 trillion soams. The relative level of loans to GDP

amounted to 41,3 %. From this we can be concluded that the country's creative work is really widespread the demand for

money is growing and this indicates that the level of credit supply is increasing. However, the fact that the relative level of loans

to GDP increased by only 0,1 % compared to the previous year we can say that it has not increased shows that the loans

allocated to the real sector in this country are insufficient (Table 2).

In order to study the investment potential of the banking sector today and study the opportunities for banks to finance

investment projects the activities of the country's leading commercial banks "Agrobank" and "Ravnaq-Bank" were analyzed.

Analyzing the indicators in Table 2: The trend of changing the financial performance of Agrobank has been growing steadily

over the years. According to Ravnaq-Bank the bank's total assets loan portfolio and investments have shown good growth rates

since 2016. However, the investment performance of the two banks is very low compared to other indicators and even in

Ravnaq-Bank we can see that this figure has decreased in the last year. From this, we can see that the bulk of the bank’s

revenue is accounted for by bank loans and that the investments provide almost nothing for the bank’s revenue portion. This

situation deprives the bank of investment activity income, which is a significant source of income for banks in the world

practice.

Table 2 Balance indicators of "Agrobank" and "Ravnaq-bank", billion soums [10]

2015 2016 2017 2018 2019

Agroban Ravnaq Agroban Ravnaq Agroban Ravnaq Agroban Ravnaq Agroban Ravnaq

№ Name

k -bank k -bank k -bank k -bank k -bank

Investment

1 71,6 0,040 72,5 0,040 186,9 0,5 168,7 3,3 130,0 3,0

s

2 Credits 223,1 43,9 317,6 100,1 476,9 162,1 1108,2 315,6 4462,2 397,2

3 Total assets 2899,0 93,7 3192,5 239,1 3949,4 340,4 4981,5 438,8 10363,0 608,6

Charter

4 263,5 15,7 317,6 20,0 367,6 22,8 1335,6 100 2163,0 100

capital

The above situation in turn has a negative impact on the loan for each loan, the payback period of the project, the

bank's profitability. Therefore, today there are the following sector of the economy in which the loan is issued and

problems in expanding the participation of commercial provide credit tracking and consulting services;

banks as investors in public investment programs:

Modernization of key industries in the country to

the growth rate of bank capital lags behind the increase the volume of bank's own assets, in particular,

development needs of the bank and the needs of bank to expand the use of project financing in the financing of

financing of the real sector of the economy; investment projects by banks;

significant growth of net profit reduces the efficiency of Improving the investment policy of commercial banks

attracting additional resources at the expense of including, increase the share of investment assets in the

interest; asset structure, optimization of investment portfolio

structure, we believe that it is necessary to increase the

commercial banks sell their shares at a very low rate to

level of diversification of bank assets through the sale of

expand the base of long-term credit and investment

non-profit assets and strengthen the organizational

resources;

structure of investment departments.

the bank's issuance and investment policies are not

References

interrelated, increase in the bank's equity does not lead [1] Sh. Mirzieyov “The results of social development of

to an increase in the bank's equity in other joint-stock the country in 2016 and the most important

companies;

directions of the economic doctrine for 2017 “

As a result, investment activity in the bank has become an dedicated lecture. People's Choice, January 16, 2017.

insignificant secondary activity sector. № 11 (6705);

Conclusion/Recommendations [2] Faulkender, Michael W. W. and WANG, Rong.

The following generalized proposals and recommendations Corporate Financial Policy and the Value of Cash.

for financing and improving investment projects through (2006). Journal of Finance. 61, (4), 1957-1990. 3.

bank loans have been developed: Miguel Ferreiraва Pedro MatosArticle in Journal of

Investment projects – According to the principle of Financial Economics 88(3):499-533 February 2008

with 323 Reads;

repayment of lending practice the organization of loan

repayment in several stages depending on the type of

ID: IJTSRD41106 | Special Issue on Innovative Development of Modern Research Page 128