Page 132 - Combine

P. 132

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

business plans submitted by customers to commercial banks that in order to ensure national growth in the country the

for investment projects [6]. quantitative growth of the country's GDP by 2025 will reach

350 trillion soums. Assuming that the total amount of loans

Today the credit policy of the country's commercial banks required from banks to achieve this result is 25.543 trillion

has a number of shortcomings. Therefore, the main purpose

soums.

of this article is to identify the existing problems in the

practice of lending to investment projects of commercial One of the factors of sustainable development of the

banks to study the priorities of lending practices of foreign economy is the financing of innovative projects. In this

banks on the basis of practical analysis to present their best process the increase in employment and a comparative

practices in the lending practice of commercial banks in analysis of these indicators will be determined by the

Uzbekistan. development of appropriate recommendations on this basis.

Research Methodology Analysis аnd results

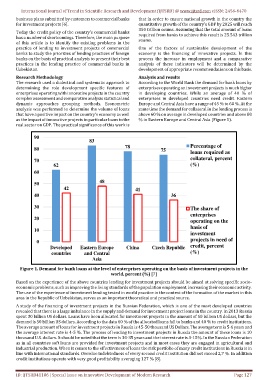

The research used a dialectical and systematic approach to According to the World Bank the demand for bank loans by

determining the role development specific features of enterprises operating on investment projects is much higher

enterprises operating with innovative projects in the country in developing countries. While an average of 40 % of

complex assessment and comparative analysis statistical and enterprises in developed countries need credit. Eastern

dynamic approaches grouping methods. Econometric Europe and Central Asia have a range of 45 % to 60 %. At the

analysis was performed to determine the volume of loans same time the demand for collateral in the lending process is

that have a positive impact on the country's economy as well above 60 % on average in developed countries and above 80

as the impact of innovative projects in particular loans to the % in Eastern Europe and Central Asia (Figure 1).

real sector on GDP. The practical significance of this work is

90

83

78 Percentage of

80 75

loans required as

collateral, percent

70

62 (%)

60

48

50

42 41

40 36

30 The share of

enterprises

20

operating on the

basis of

10

investment

projects in need of

0

Developed Eastern Europe China Czech Republic credit, percent

countries and Central (%)

Asia

Figure 1. Demand for bank loans at the level of enterprises operating on the basis of investment projects in the

world, percent (%) [7]

Based on the experience of the above countries lending for investment projects should be aimed at solving specific socio-

economic problems, such as improving the living standards of the population employment, increasing their economic activity.

The use of the experience of investment lending tested in world practice in the context of the formation of the market in this

area in the Republic of Uzbekistan, serves as an important theoretical and practical source.

A study of the financing of investment projects in the Russian Federation, which is one of the most developed countries

revealed that there is a large imbalance in the supply and demand for investment project loans in the country. In 2013 Russia

spent 30 billion US dollars. Loans have been allocated for investment projects in the amount of 50 billion US dollars, but the

demand is 50 billion US dollars. According to the data 60 % of the allocated loans fall to banks and 40 % to credit institutions.

The average amount of loans for investment projects in Russia is 45-50 thousand US Dollars. The average term is 5-6 years and

the average interest rate is 4-5 %. The process of lending to investment projects in Russia the amount of these loans is 10

thousand U.S. dollars. It should be noted that the term is 30-35 years and the interest rate is 3-15%. In the Russian Federation

as in all countries soft loans are provided for investment projects and in most cases they are engaged in agricultural and

industrial production. When it comes to the effectiveness of loans the risk portfolio of many credit institutions in Russia is in

line with international standards. Overdue indebtedness of every second credit institution did not exceed 2,7 %. In addition

credit institutions operate with very good profitability averaging 127 % [8].

ID: IJTSRD41106 | Special Issue on Innovative Development of Modern Research Page 127