Page 22 - Combine

P. 22

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

Figure 2

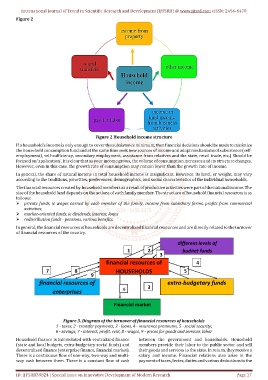

Figure 2 Household income structure

If a household’s income is only enough to cover the subsistence minimum, then financial decisions should be made to minimize

the household consumption fund and at the same time seek new sources of income and adapt mechanisms of subsistence (self-

employment), self-sufficiency, secondary employment, assistance from relatives and the state, retail trade, etc.) Should be

focused on ‘application’. It is clear that as your income grows, the volume of consumption increases and its structure changes.

However, even in this case, the growth rate of consumption may remain lower than the growth rate of income.

In general, the share of natural income in total household income is insignificant. However, its level, or weight, may vary

according to the traditions, priorities, preferences, demographics, and social characteristics of the individual households.

The financial resources created by household members as a result of productive activities were part of the national income. The

size of the household fund depends on the actions of each family member. The structure of household financial resources is as

follows:

private funds, ie wages earned by each member of the family, income from subsidiary farms, profits from commercial

activities;

market-oriented funds, ie dividends, interest, loans

redistribution funds - pensions, various benefits.

In general, the financial resources of households are decentralized financial resources and are directly related to the turnover

of financial resources of the country.

different levels of

1 2 budget funds

3

financial resources of 4

7 8 HOUSEHOLDS 5

9

financial resources of extra-budgetary funds

3

6

enterprises

Financial market

Figure 3. Diagram of the turnover of financial resources of households

1 - taxes, 2 - transfer payments, 3 - loans, 4 - insurance premiums, 5 - social security,

6 - savings, 7 - interest, profit, rent, 8 - wages, 9 - prices for goods and services, labor

Household finance is interrelated with centralized finance between the government and households. Household

(state and local budgets, extra-budgetary social funds) and members provide their labor to the public sector and sell

decentralized finance (enterprise finance, financial market). their goods and services to the state. In return, they receive a

There is a continuous flow of one-way, two-way and multi- salary and income. Financial relations also arise in the

way cash between them. There is a constant flow of cash payment of taxes, levies, duties and various deductions to the

ID: IJTSRD39824 | Special Issue on Innovative Development of Modern Research Page 17