Page 140 - Combine

P. 140

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

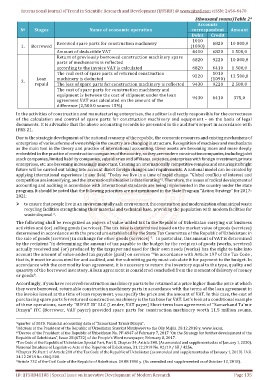

(thousand soums)Table 2

4

Accounts

№ Stages Name of economic operation correspondent Amount

Debit Credit

1010

Received spare parts for construction machinery 6820 10 000,0

1. Borrowed (1090)

Amount of deductible VAT 4410 6820 1 500,0

Return of previously borrowed construction machinery spare 6820 9220 10 000,0

parts of mechanisms is reflected

according to the invoice VAT is calculated 6820 6410 1 500,0

The real cost of spare parts of returned construction 9220 1010 12 500,0

Loan machinery is deducted (1090)

2.

repaid The loss of spare parts for construction machinery is reflected 9430 9220 2 500,0

The cost of spare parts for construction machinery and

equipment is between the cost of shipment under the loan 9430 6410 375,0

agreement VAT was calculated on the amount of the

difference (2,500.0 soums 15%)

In the activities of construction and manufacturing enterprises, the auditor is directly responsible for the correctness

of the calculation and control of spare parts for construction machinery and equipment - on the basis of legal

documents. It is advisable that the above accounting records be presented in the auditor's report in accordance with

IFRS 21.

Due to the strategic development of the national economy of the republic, the economic resources and existing mechanisms of

enterprises of various forms of ownership in the country are changing in structure. Recognition of machines and mechanisms

as the main tool in the theory and practice of international accounting, these assets are becoming more and more deeply

embedded in the practice of construction companies of the country, so they are modern construction companies, including joint

stock companies, limited liability companies, subsidiaries and affiliates. societies, enterprises with foreign investment, private

enterprises, etc. are becoming increasingly important. Creating an internationally competitive complex and ensuring its bright

future will be carried out taking into account direct foreign changes and requirements. A national model can be created by

applying international experience in any field. "Today we live in a time of rapid change. "Global conflicts of interest and

5

competition are intensifying, and the international situation is deteriorating" . Therefore, the issues of radical development of

accounting and auditing in accordance with international standards are being implemented in the country under the state

program. It should be noted that the following priorities are not mentioned in the State Program "Action Strategy" for 2017-

2021:

to ensure that people live in an environmentally safe environment, the construction and modernization of municipal waste

recycling facilities strengthening their material and technical base, providing the population with modern facilities for

6

waste disposal .

The following shall be recognized as payers of value-added tax in the Republic of Uzbekistan carrying out business

activities and (or) selling goods (services). The tax base is determined based on the market value of goods (services)

determined in accordance with the procedure established by the State Tax Committee of the Republic of Uzbekistan: in

the sale of goods (services) in exchange for other goods (services) . In particular, this amount of VAT is determined

7

by the recipient “in determining the amount of tax payable to the budget by the recipient of goods (works, services)

actually received and (or) produced by the taxpayer and used for their own needs (works) has the right to take into

account the amount of value-added tax payable (paid) on services ” in accordance with Article 197 of the Tax Code ,

8

that is, it must be accounted for and audited, and the submitting party must calculate it for payment to the budget. In

accordance with the commodity loan agreement, it is necessary to return the inventory equal to the type, quality and

quantity of the borrowed inventory. A loan agreement is considered concluded from the moment of delivery of money

or goods .

9

Accordingly, if you have received construction machinery parts to be returned at a price higher than the price at which

they were borrowed, returnable construction machinery parts in accordance with the terms of the loan agreement in

the invoice issued at the time of loan repayment. you specify the price and the amount of VAT. In this case, the cost of

purchasing spare parts for returned construction machinery is the tax base for VAT. Let's look at a conditional example

of these operations, namely "SUFAT ID" LLC (Lender, VAT payer) Short-term loan agreement of "Samarkand Ta’mir

Dizayn" ITC (Borrower, VAT payer) provided spare parts for construction machinery worth 11.5 million soums,

4 quarter of 2020. Financial accounting data of “Samarkand Ta’mir Dizayn”.

5 Address of the President of the Republic of Uzbekistan Shavkat Mirziyoyev to the Oliy Majlis. 28.12.2018 y. www.lex.uz.

6 “Decree of the President of the Republic of Uzbekistan No. PF-4947 of February 7, 2017 "On the Strategy for further development of the

Republic of Uzbekistan", Issue 28 (6722) of the People's Word newspaper, February 8, 2017.

7 Tax Code of the Republic of Uzbekistan Special Part, Part X, Chapter 34, Article 248. (As amended and supplemented as of January 1, 2020).

National Database of Legislative Acts of the Republic of Uzbekistan, 31.12.2019 No. 02/19 / SK / 4256.

8 Chapter 39, Part 1 of Article 218 of the Tax Code of the Republic of Uzbekistan (as amended and supplemented as of January 1, 2019). UzR.

24.12.2018 No. ORQ-508.

9 Article 732 of the Civil Code of the Republic of Uzbekistan. 29.08.1996 y. (As amended and supplemented as of October 12, 2018).

ID: IJTSRD41108 | Special Issue on Innovative Development of Modern Research Page 135