Page 145 - Combine

P. 145

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

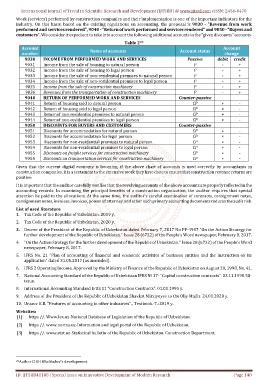

Work (services) performed by construction companies and their implementation is one of the important indicators for the

industry. On this basis, based on the existing regulations on accounting, the proposal is 9030 - "Revenue from work

performed and services rendered", 9040 - "Return of work performed and services rendered" and 9050 - "Buyers and

customers”. We consider it expedient to take into account the following additional accounts in the "given discounts" accounts.

Table 2

29

Account Account

Name of accounts Account status

number change

9030 INCOME FROM PERFORMED WORK AND SERVICES Passive debit credit

9031 Income from the sale of housing to natural person P - +

9032 Income from the sale of housing to legal person P - +

9033 Income from the sale of non-residential premises to natural person P - +

9034 Income from the sale of non-residential premises to legal person P - +

9035 Income from the sale of construction machinery P - +

9036 Revenues from the transportation of construction machinery P - +

9040 RETURN OF PERFORMED WORK AND SERVICES Counter-passive

9041 Return of housing sold to natural person CP + -

9042 Return of housing sold to legal person CP + -

9043 Returnof non-residential premises to natural person CP + -

9044 Returnof non-residential premises to legal person CP + -

9050 DISCOUNTS FOR BUYERS AND CUSTOMERS Counter-passive

9051 Discounts for accommodation for natural person CP + -

9052 Discounts for accommodation for legal person CP + -

9053 Discounts for non-residential premises to natural person CP + -

9054 Discounts for non-residential premises to legal person CP + -

9055 Discounts on freight services for construction machinery CP + -

9056 Discounts on transportation services for construction machinery CP + -

Given that the current digital economy is booming, if the above chart of accounts is used correctly by accountants in

construction companies, it is a testament to the extensive work they have done to ensure that construction revenue returns are

positive.

It is important that the auditor carefully verifies that the revolving accounts of the above accounts are properly reflected in the

accounting records. In examining the principal benefits of a construction organization, the auditor requires that special

attention be paid to the allocations. At the same time, the auditor's careful examination of contracts, consignment notes,

consignment notes, invoices, invoices, power of attorney and other such primary accounting documents reduces the audit risk.

List of used literature

1. Tax Code of the Republic of Uzbekistan. 2019 y.

2. Tax Code of the Republic of Uzbekistan. 2020 y.

3. Decree of the President of the Republic of Uzbekistan dated February 7, 2017 No PF-4947 "On the Action Strategy for

further development of the Republic of Uzbekistan." Issue 28 (6722) of the People's Word newspaper, February 8, 2017.

4. "On the Action Strategy for the further development of the Republic of Uzbekistan." Issue 28 (6722) of the People's Word

newspaper, February 8, 2017.

5. IFRS No. 21 “Plan of accounting of financial and economic activities of business entities and the Instruction on its

application” dated 31.05.2017 (as amended).

6. IFRS 2 Operating Income. Approved by the Ministry of Finance of the Republic of Uzbekistan on August 20, 1998, No. 41.

7. National Accounting Standard of the Republic of Uzbekistan IFRS № 17- "Capital construction contracts". 02.11.1998.58-

issue.

8. International Accounting Standard IFRS 11 “Construction Contracts”. 01.01.1995 y.

9. Address of the President of the Republic of Uzbekistan Shavkat Mirziyoyev to the Oliy Majlis. 24.01.2020 y.

10. Urazov K.B. "Features of accounting in other industries"., Textbook.-T.:2019 y.

Websites:

[1] https //. Www.lex.uz-National Database of Legislation of the Republic of Uzbekistan.

[2] https //. www.norma.uz-Information and legal portal of the Republic of Uzbekistan.

[3] https //. www.stat.uz-Statistical bulletin of the Republic of Uzbekistan. Construction Department.

29 Author O.KH Khalikulov's development.

ID: IJTSRD41108 | Special Issue on Innovative Development of Modern Research Page 140