Page 144 - Combine

P. 144

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

25

Credit 4010 "Accounts receivable from buyers and customers"

Proceeds from the sale will be transferred to the final financial result account at the end of the reporting period. To this end, the

auditor compares the entries in the debit of account 9030 "Income from works and services" in the construction company with

the entries in the credit account 9900 "Final financial result". These data are compared with the General Ledger, the current

accounts in the 1S program, and the Financial Statement Form 2 “Financial Performance Report” indicators. Other income from

operating activities in the process of profit audit in construction organizations, ie income from the sale of fixed assets (account

9310), income from the sale of other assets (account 9320), levied fines (account 9330), income from other main activities

(9340 and on account 9390). Penalties will be credited to account 5110, which is a cash account. At the end of the reporting

period, these revenues will also be transferred to account 9900, Final Financial Results. It is important for the auditor to pay

particular attention to the accuracy of such accounting transactions in the accounts.

The profitability of construction companies is an important indicator of quality and efficient use of resources. Depending on the

amount of profit received, it is possible to know the return on assets. The audit provides an opportunity to develop sound

recommendations for further enhancing the profitability of the analyzed asset by type of asset. Profit is an important object of

the audit. The auditor verifies that the benefits have been properly accounted for under the contract and have been used in

accordance with regulatory requirements during the year. Such an audit is carried out through accounts 8710 "Retained

earnings (uncovered losses) for the reporting period", 9900 - "Final financial result" and other accounts. The auditor verifies

the correctness of the construction company's profitability through the following operations::

verification of transactions by type of income received;

check transactions by type of expense incurred;

review of profit transactions used during one financial period.

The audit of the construction company's profit is carried out by checking the accounting entries in the account 9900 - "Final

financial result". We approach such an inspection procedure on the example of the construction company SUFAT i D. The

following entries were made in the account 9900 - "Final financial result" of construction organizations for the reporting

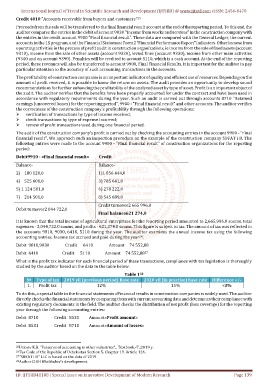

period:

Debit9910 - «Final financial result» Credit

Balance- Balance-

2) 180 120,0 1)1 056 444,0

4) 525 600,0 3) 785 641,0

5) 1 124 501,0 6) 278 222,0

7) 214 501,0 8) 545 689,0

Credit turnover2 665 996,0

Debit turnover2 044 722,0

Final balance621 274,0

It is known that the total income of agricultural enterprises for the reporting period amounted to 2,665,996.0 soums, total

expenses - 2,044,722.0 soums, and profits - 621,274.0 soums. This figure is subject to tax. The amount of tax was reflected in

the accounts 9810, 9030, 6410, 5110 during the year. The auditor examines the annual income tax using the following

26

accounting entries. Income tax accrued and paid during the year :

Debit 9810,9030 Credit 6410 Amount 74 552,88

Debit 6410 Credit 5110 Amount 74 552,88

27

What is the profit tax indicator for each financial period of these transactions, compliance with tax legislation is thoroughly

studied by the auditor based on the data in the table below.

Table 1

28

№ Type of tax 2019 yil (previous period) Base rate 2020 yil (in practise) base rate Difference +/-

1. Profit tax 12% 15% +3%

To do this, a special table in the financial statements «Financial results in construction companies is widely used. The auditor

directly checks the financial statements by comparing them with current accounting data and determines their compliance with

existing regulatory documents in the field. The auditor checks the distribution of net profit (loss coverage) for the reporting

year through the following accounting entries:

Debit 8710 Credit 8531 Amount«Profit amount»

Debit 8531 Credit 8710 Amount«Amount of losses»

25 Urazov K.B. "Features of accounting in other industries"., Textbook.-T.:2019 y.

26 Tax Code of the Republic of Uzbekistan Section 5. Chapter 19. Article 126.

27 "SUFAT i D" LLC is based on the data of 2019.

28 Author O.KH Khalikulov's development.

ID: IJTSRD41108 | Special Issue on Innovative Development of Modern Research Page 139